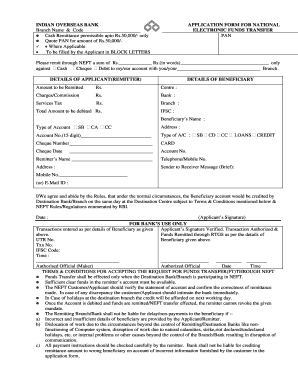

RTGS / NEFT Transactions Limit For Under Retail Internet Banking Users.State Bank of India RTGS and NEFT Charges.Let us learn Filling the SBI RTGS form or SBI NEFT form.What’s the time for the NEFT system and RTGS system in the State Bank of India?.Data Required for transfer of Funds through SBI RTGS/NEFT Application Form 2021.If You have any queries related to rtgs form Allahabad bank, Allahabad bank NEFT Form, or RTGS Services, Feel Free to Share with us in the comments below and We will Get back to You Soon. We Hope with the Help of This Article Now You can Easily Download the Allahabad bank rtgs form PDF Online. Beneficiary Account Number with Branch and IFSC Code.What are the Essentials Information the Customers Needs to Fill to Make any RTGS transactions? In RTGS the Transactions Have the Legal Backing.All the Transactions Charge in RTGS is Capped by RBI.No Delay in Fund Transfer, transactions Happens in Real-time.There is No amount CAP in RTGS Transactions.RTGS is one of the Safest & Secure way of Fund Transfer.Make sure You Fill al the Details Properly or else Bank will Not Clear Your Request.

Note – Beneficiary Account Number & IFSC Code is Very Important.

Transactions Charges – The RTGS Transactions charges are very Minimal, For ₹ 2,00,000/- to 5,00,000/-: not exceeding ₹ 24.50/. RTGS Timings – RTGS is Not a 24×7 Service, the timings can depend on the Branch Location But usually, in Most of the Branch the RTGS Timings are from 7 am to 6 pm on a working day. Customers can Get the Print out of Form for Further Submission on Branch. The RTGS form Allahabad bank is Available in Both PDF & Printable Format. RTGS ( Real-time Gross Settlement ) is one of the Most Secure and Fast ways to Transferring Fund to other Bank Account.Īccount Holders can Wish to fill the RTGS form Allahabad bank and Submit to Their Branch or You can also use Internet Banking for NEFT/ RTGS Services. Allahabad Bank NEFT & RTGS Services are one of them. The Allahabad Bank offers various Banking and Financial Services to its Customers. Benefits of Allahabad Bank RTGS Services.How to Fill Your Allahabad Bank RTGS/NEFT Form?.

0 kommentar(er)

0 kommentar(er)